Retired individuals in the UK will outlive their retirement savings by more than ten years, with women worse off than men, according to latest research.

A report from the World Economic Forum, published yesterday (June 13), found that retirement funds were not increasing fast enough to cover the cost of rising life expectancies.

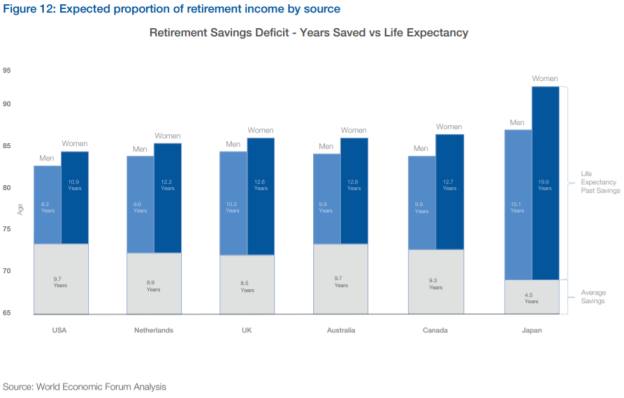

It found that the average female in the UK will outlive her savings by 12.6 years, compared to the average man who will run out of savings 10.3 years prior to their death.

The WEF modelled its UK analysis on the default fund strategy adopted by Nest, the government-backed workplace pension scheme.

Out of the six countries the WEF studied, retirees in Japan will run out of savings the quickest, with women expected to outlive their savings by 19.9 years, compared to men at 15.1 years.

In terms of accrued savings American and Australian individuals fared the best as they had savings which were expected to last 9.7 years, compared to 8.5 years for the average UK retiree.

The WEF said: "These shortfalls must be addressed by both individuals and policy-makers to ensure that seniors can enjoy life throughout their non-working years.

"Though governments should act, they would be wise to avoid implementing one-size-fits-all retirement policies as individual retirement needs can vary greatly from person to person.

"Instead, governments should change, or even roll back, their regulations to allow individuals to make investments that will increase their long-term returns."

The report outlines how individuals must choose the best investments based on the long-term to ensure they have enough savings to carry them through retirement.

While consistent saving is important to build retirement funds, being mindful of long-term returns on retirement portfolios is crucial to ensuring that an individual doesn’t outlive their savings, the WEF stated.

Han Yik, head of the institutional investors industry at the WEF, said: "The real risk people need to manage when investing in their future is the risk of outliving their retirement savings.

"As people are living longer, they must ensure they have enough retirement funds to last them through their longer lives. This requires investing with a long-term mindset earlier in life to increase total savings later on."

The WEF has also called on governments to consider reforms to investment freedoms so that individuals are able to choose funds which are expected to generate strong returns over the long-term.

It stated that target date funds, which typically take more risks when savers are young and gradually get more conservative with investments over time, enable individuals to build their savings pots earlier on in life when they tend to have a greater income.

The report stated: "While target-date funds will not be suitable for all savers and there are differences in how these can be structured, we support the notion of taking more investment risk earlier when earning ability can be deployed more flexibly and the potential impact of market downturns can be mitigated over time.