"However, mortgage payment holidays are quickly/easily available, and lenders have been granting these with no underwriting (rather, the answer of three simple questions) and many have increased this facility from three to six months."

That said, these 'holidays' are coming to an end, as well as the stamp duty land tax break, which means consumers who still feel financially vulnerable need to start talking to brokers and lenders about what their options might be later this year.

The regulator says it expects lenders to exercise appropriate tolerance (forbearance) where this is in a customer’s interest, taking into account their individual circumstances.

FCA rules around mortgage payment deferrals

The FCA also announced a moratorium on lender repossession last year – first until October 31 and then a further moratorium on enforcement of lender repossession, the level of repossessions may not jump up after the grace period ends.

On January 14, the FCA issued proposed guidance stating repossessions should not take place until April 1 this year.

According to UK Finance: "160 homeowner mortgaged properties and 230 buy-to-let mortgaged properties were taken into possession in the third quarter of 2020, 88 per cent and 71 per cent fewer, respectively, than in the same quarter of the previous year.

"Following the industry moratorium on involuntary possessions, these low possessions numbers in Q3 2020 for the most part reflect cases where the customer requested the possession to go ahead or where the property was vacant."

But even if the grace period ends soon, market commentators do not believe lenders want to follow through with the warning: "Your home may be at risk if you do not keep up the repayments" and end up with a book full of housing stock they then have to sell.

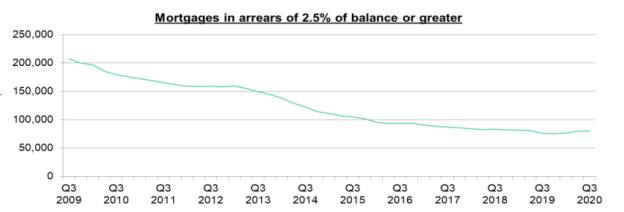

This may be one reason why the level of arrears is relatively low, compared with the financial crash in 2008-09 (see graphic, below, from UK Finance).

UK Finance figures at the end of November last year showed there were 74,850 homeowner mortgages in arrears of 2.5 per cent or more of the outstanding balance in the third quarter of 2020.

This was 5 per cent greater than in the same quarter of the previous year, but nowhere near the heights of 2009, when the global financial crisis saw residential mortgage arrears skyrocket and repossessions rise to record highs.

According to UK Finance figures, there were more than 200,000 homeowner mortgages in arrears of 2.5 per cent or more in 2009; we are nowhere near that figure yet.

That said, it may be too early to gauge the long-term effect of the pandemic on mortgage arrears just yet, with some government support schemes still in place for Britons and the mortgage support schemes only just winding to a close.