The estimated size of the UK’s life insurance market is set to fall by 8.5 per cent in 2023 following three years of consecutive growth, analysis by Final Duties has revealed.

The analysis, which examined data on the market size of the sector based on revenue, found that total market size is estimated to fall to £65.4bn.

This represents an 8.5 per cent fall on the decade high of £71.4bn that was recorded in 2022.

However, despite this fall, the 2023 market remains some 226 per cent larger when compared to the pre-pandemic low seen in 2019.

Pandemic's influence

The analysis showed that, prior to the pandemic, the sector peaked at £66.3bn in 2017, an increased on the £54.7bn from 2013.

However, this peak was followed by two consecutive years of decline, with the sector’s value falling to £20bn in 2019.

However, following the outbreak of Covid-19 in early 2020, the size of the insurance market “exploded”, increasing by 132.4 per cent to £46.6bn.

Jack Gill, managing director of Final Duties, said: “It’s hardly surprising that the importance of life insurance was brought to the forefront due to such an unprecedented event as the Covid pandemic.

“This caused the sector to grow to its largest in a decade and, while the growth now has started to subside, the life insurance market remains substantially larger than the pre-pandemic landscape.”

Assurance

However, one aspect of the sector that remained largely unaffected by the pandemic, according to data from Swiss Re, were term assurance sales.

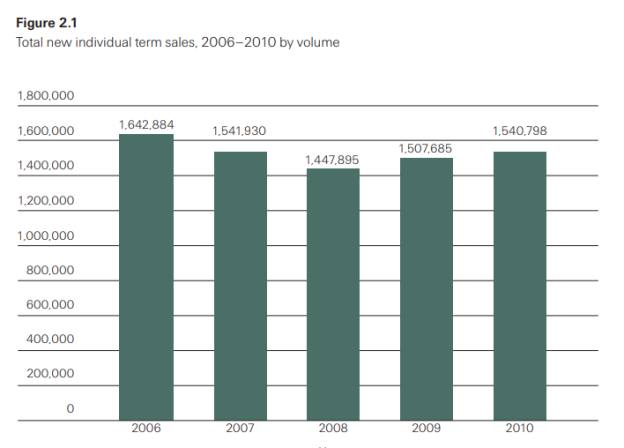

Source: Swiss Re

The graph, depicting new individual term assurance policy sales across a number of years, showed that sales slightly increase each consecutive year up to the peak of 2019 when it decreased.

Additionally, the sales of 1,587,829 recorded in 2020 are less than the number recorded by Swiss Re in 2006 as the following graph makes clear:

However, while total sales decreased from 2019 to 2020, an increase was discovered in the policies that did not include critical illness protection which rose to 1,159,082.

This represented more sales than occurred in any year in the previous decade with 2006 only seeing 1,123,031 such sales.

Policy holdings

Final Duties's analysis stated the increase in revenues versus the pre pandemic landscape comes despite the fact that less people hold life insurance policies.

Additional analysis showed the number of life insurance policies is predicted to fall by 2.5 per cent in 2023 to 26.3mn across the UK.

This follows the trend of declining revenues in 2023 but this trend has been “developing for some time”, with total policy number falling consistently since 2018.

This suggests, according to Final Duties, while fewer people hold life insurance policies, those who do are opting for greater levels of cover following the pandemic.

It additionally suggested that premiums may also have climbed due to Covid.

Gill added: “Much like the other formalities associated with death, such as forming a will, life insurance is a formality that must be taken care of ahead of time, regardless of how morbid it might seem.

“It provides a financial safety net for the loved ones you leave behind and this is vitally important as we never know when our time might be up.”