I’ve never been one for putting my heels up – I’m saving that for retirement.

I’m also happy to kick the yoga, pilates and all the other mind, body, spirit stuff into the long grass, too.

But after 12 Seven Investment Management nationwide retirement-focussed roadshows, meeting almost 800 advisers, I’m having a moment of introspection.

My number one take away has to be Steve Bee. Not just for his dead-pan, dry delivery (a comedy calling surely beckons if pensions get boring). What sticks is much more serious.

Steve’s hand scrawled, tech-light presentation on the pensions crisis, time and again, was described by advisers as the best they’d seen.

As well as making me wonder why we all bother with power point, Steve’s presentation hammered home how unnecessarily complicated the industry makes everything. We don’t need to work harder.

We need to work smarter. And smarter does not mean more complicated.

We can all knock financial services jargon – words are easy. But talking the talk is much easier than walking the walk. Steve’s ‘Jargonfree’ presentation was an absolute masterclass in how less really is more.

I’m not sure what Steve makes of the new moniker coined for a hitherto-hidden generation: the ‘Xennials’ (those born between 1977 – 1983). What he did pick holes in was the definition of the ‘baby boomers’.

The statistics proved that UK baby boomers are actually much younger than their US counterparts. The US baby boom happened when the US troops came back from the war ready for more action, but it appears the UK squaddies took a few years to warm up.

The birth bonanza that followed World War two was merely a blip in the UK, with the real spurt in population growth coming between 1961 and 1972 – a group that will start to retire from 2020.

Whilst Steve isn’t so much predicting a riot, he is predicting a “tsunami hitting pensions beach” as the pensions ‘haves and have nots’ become more visible.

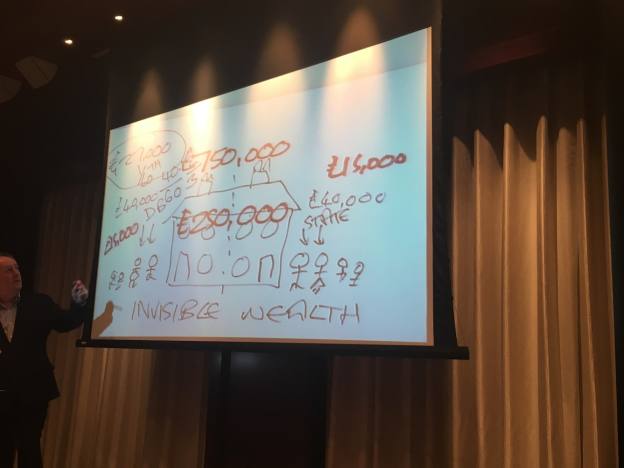

That’s because only half of the UK is in a company pension scheme. So as Mr and Mrs Jones retire with their company pension, their invisible wealth will suddenly become more apparent to Mr and Mrs Smith next door, who didn’t have a company pension. #Awkward. Keeping up with the Joneses just got harder.

Mr and Mrs Smith didn’t have a company pension, but did have the same house, same type of car, and the de rigueur 2.4 children. They’ve probably been working just as hard as the Joneses, too.

Here’s one of the ways Steve illustrated it:

Certainly the issue of managing your money throughout retirement – and the risk of it running out – does feel like a tsunami waiting to happen. Pension freedoms have brought all of this into sharp focus.