Faced with the prospect of a lower yielding environment, investors are having to cast their nets wider geographically and across more asset classes in order to meet their income targets.

Jamie Clark, fund manager, macro team at Liontrust, believes: “Many income investors seem unprepared for the scare of rising inflation expectations. The lack of yield arising from the impression of permanent easy money has encouraged herding into equities with fixed-income characteristics.”

He cautions: “Consumer staples are a case in point. The recent bump in inflation expectations and corresponding pull back in such bond proxies suggest the trade is on borrowed time.”

However, analysis by BlackRock finds dividend income is poised to become a larger component of lower overall portfolio returns over the next five years.

As Richard Turnill, BlackRock’s global chief investment strategist, points out: “Bond yields have likely bottomed out, and we don’t see scope for big rises in already elevated stockmarket valuations amid tepid earnings growth.”

He continues: “High-yielding dividend stocks typically suffer more when rates rise than dividend growers – quality companies with enough free cashflow to sustain dividend increases over time. Yet even many of these stocks could generate positive returns in a gradually rising yield environment.”

Mr Turnill sees dividend growth opportunities globally but particularly in companies within the technology, consumer discretionary and financials sectors.

Bertrand Cliquet, manager of the Lazard Global Franchise fund, believes there are two clear headwinds for equities. “One is an economic environment that remains highly uncertain and the second is a challenging valuation backdrop,” he says.

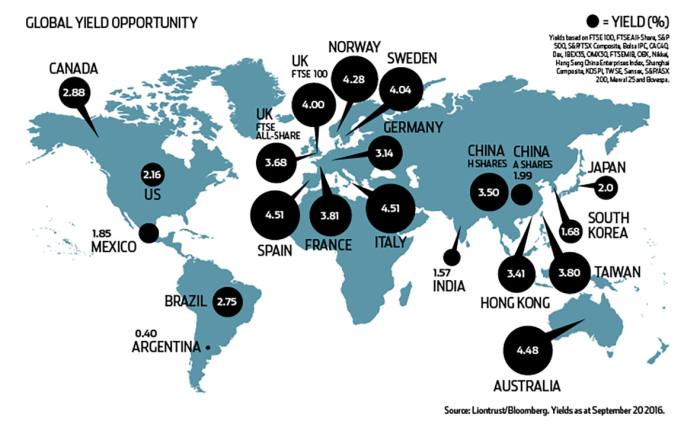

Being selective in terms of region can help reassure those investors who tend to be distracted by noise in the markets.

Olly Russ, fund manager, European income at Liontrust, observes: “Investors have been diversifying their income exposure via overseas equities in recent years but Europe remains broadly overlooked.

“Macroeconomic issues have played their part in this but, more generally, the region has struggled to cast off an outdated image as a low-yield market relative to the UK.”

There is income to be found across the globe but investors need to be discerning about which asset classes will provide a reliable income stream and look further afield than the UK.

Ellie Duncan is deputy features editor at Investment Adviser